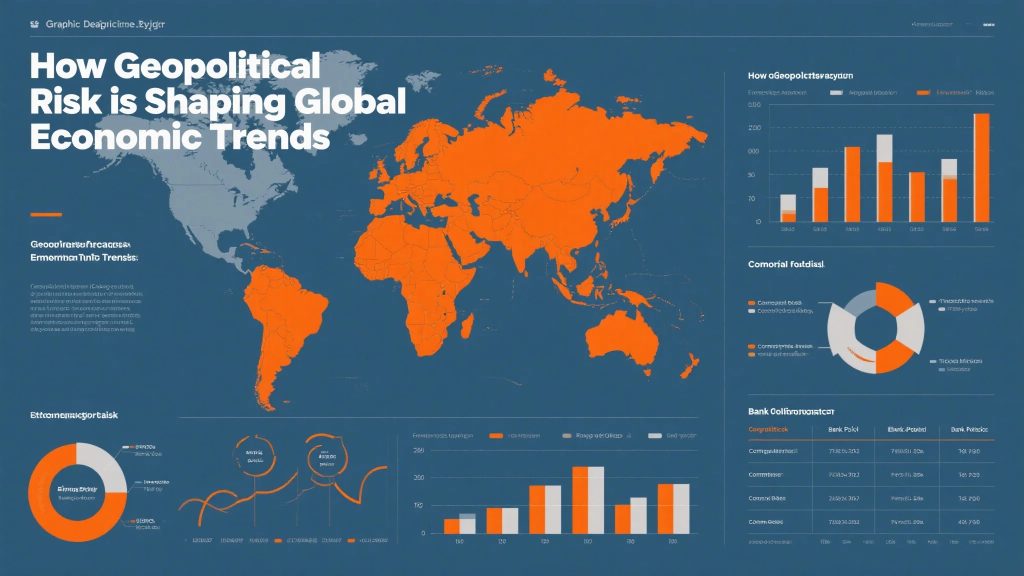

How Geopolitical Risk is Shaping Global Economic Trends

When conducting geopolitical risk analysis, professionals now incorporate scenario planning techniques originally developed for military strategy. The most sophisticated approaches examine second and third-order effects that might ripple through supply chains and financial systems. Regular updates to these models are essential as situations evolve rapidly.

Global Economic Forecast Amid Uncertainty

The latest global economic forecast models show widening divergence between regions and sectors. While some economies benefit from reshoring trends, others face structural challenges from fractured trade relationships. This bifurcation creates both risks and opportunities for internationally exposed portfolios.

Developing an accurate global economic forecast now requires incorporating political stability assessments alongside traditional economic indicators. Many institutions have established dedicated geopolitical research teams to complement their economic analysts. The interaction between these disciplines produces more robust predictions.

Emerging Markets Risk Assessment

Emerging markets risk profiles have become increasingly heterogeneous as geopolitical tensions reshape alliances and trade flows. Countries positioned as alternatives in supply chain diversification often present attractive opportunities, while those caught in geopolitical crossfires face heightened volatility.

When evaluating emerging markets risk, analysts now prioritize factors like currency reserve adequacy and energy independence alongside traditional metrics. The most comprehensive assessments examine how local political dynamics intersect with broader geopolitical trends to identify potential flashpoints.

Commodity Price Outlook and Geopolitics

The commodity price outlook remains tightly coupled with geopolitical developments, particularly in energy and critical minerals. Sanctions regimes, export controls, and strategic stockpiling initiatives all contribute to market distortions that may persist for years. Investors must account for these structural changes rather than assuming mean reversion.

Analyzing the commodity price outlook requires understanding how geopolitical alliances affect trade flows and pricing mechanisms. Many traditional correlations have broken down as politics overrides economic fundamentals in certain markets. The most successful strategies incorporate flexible approaches that can adapt to sudden shifts.

Central Bank Policy in a Fragmented World

Central bank policy decisions now occur within an increasingly politicized global environment. The weaponization of financial systems and alternative payment networks challenges traditional monetary policy frameworks. Inflation-fighting measures must account for geopolitical supply shocks that standard models don’t capture.

When interpreting central bank policy directions, analysts must consider the growing role of national security concerns in decision-making. The most insightful approaches examine how monetary policy interacts with industrial policy initiatives and strategic competition objectives.

Building Resilient Investment Strategies

The most successful portfolios combine insights from geopolitical risk analysis with global economic forecast models. They carefully assess emerging markets risk while monitoring the commodity price outlook and adapting to evolving central bank policy approaches.

This multidimensional framework helps navigate today’s complex environment where politics increasingly drives economic outcomes. Regular strategy reviews ensure alignment with the rapidly changing geopolitical landscape.

Implementing Geopolitically Aware Portfolios

Proper implementation requires coordination between investment professionals, geopolitical analysts, and risk management teams. Asset allocations must reflect both current tensions and longer-term structural shifts. Beginning the process with clear objectives ensures consistency during periods of heightened volatility.

By understanding these geopolitical-economic interactions, investors can position their portfolios to weather various scenarios. The combination of disciplined analysis and flexible execution creates opportunities even in challenging environments.